In the dynamic world of personal finance management, fintech innovations are making significant strides, and Credit Strong positions itself as a key player for individuals focused on credit improvement. This review examines Credit Strong’s offerings, like secured credit accounts and loans, designed to bolster credit scores effectively. As the fintech landscape continues to evolve and provide new avenues for financial empowerment, it becomes crucial to understand how services like Credit Strong help users navigate their credit-building journeys. With a commitment to enhancing financial health, Credit Strong emerges as a noteworthy solution among the plethora of credit enhancement tools available today, promising a blend of accessibility and impactful results for those aiming to elevate their financial standing.

What is Credit Strong?

Credit Strong is more than a fintech participant; it’s purposefully designed to guide consumers toward financial wellness via credit improvement. Credit Strong offers secured credit accounts and loans, providing a practical path to establish or repair credit histories. Its standout feature is the commitment to empowering consumers, providing a framework that’s not only accessible but also impactful for a diverse range of credit-building needs. Unlike traditional banking systems that might seem impersonal or daunting, Credit Strong’s approach is personalized and user-focused, aiming to demystify the credit-building process and make financial growth attainable for everyone. This ethos of consumer empowerment and inclusivity sets Credit Strong apart in the crowded landscape of credit improvement solutions, highlighting its role as a catalyst for financial health and stability.

The essence of Credit Strong lies in its innovative blend of products that resonate with a broad spectrum of financial goals, from newcomers in the credit scene to those amid credit repair. Its strategic focus on accessibility—eliminating barriers like initial credit checks—paves the way for more individuals to engage in credit-building activities confidently. Furthermore, Credit Strong’s dedication to offering tailored services underscores its understanding that financial health is not one-size-fits-all. Each secured account and loan product is thoughtfully designed to meet users where they are in their financial journey, making Credit Strong a significant player in the evolution of consumer financial services, where the ultimate goal is to turn the aspiration of improved credit into a tangible reality for its users.

How Does Credit Strong Work?

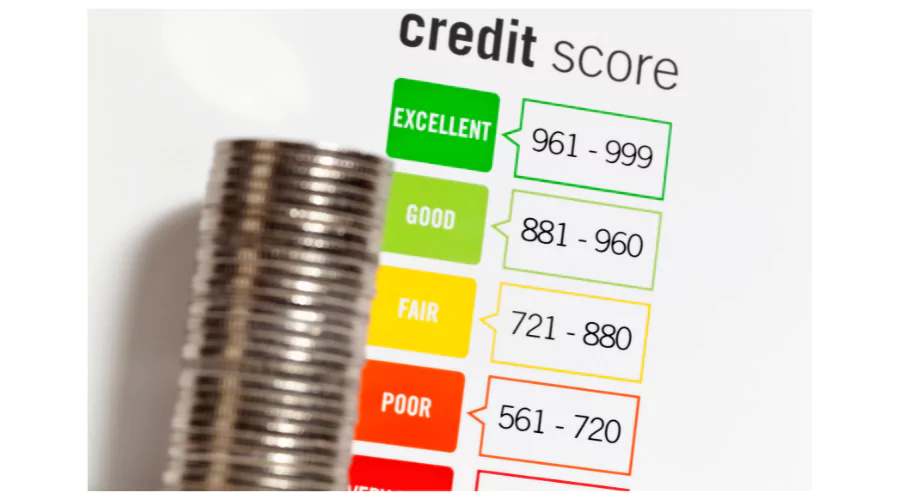

The platform simplifies credit improvement by providing secured credit accounts and loans for diverse credit-building needs. Starting an account is straightforward, welcoming users from all credit backgrounds to boost their scores. Its effectiveness comes from regular reports to major bureaus, ensuring timely payments improve credit history. This approach leads to gradual credit score improvement, assuming users uphold consistent, responsible financial behavior. Aimed at helping both newcomers and those repairing their scores, the methodology highlights how fintech facilitates accessible and transparent financial progress for all.

Here’s how it works:

- Open a CreditStrong Revolv account for $99/year.

- CreditStrong reports a $1,000 bank-issued line of credit with a $0 balance.

- Make optional Savings Payments to increase the line of credit to $3,000.

- Payments are 2% – 9% of the credit limit ($20-$90).

- Optional Savings Payments also help build a positive payment history.

- You retain 100% of the savings payments.

Exploring the Credit Strong App

The Credit Strong app epitomizes the fusion of technology and financial empowerment, providing a user-centric platform for managing credit-building accounts with ease and efficiency. Designed with an intuitive interface, it simplifies credit score monitoring, account management, and accessing customer support. Security is a cornerstone of the app, ensuring users’ financial information is protected with state-of-the-art technology. Beyond account management, the app provides educational resources and tools to boost financial literacy and credit-building understanding. This approach not only aids users in navigating their credit improvement journey but also empowers them to make informed decisions, reflecting Credit Strong’s commitment to fostering financial health through innovation and user engagement.

Credit Strong Reviews

Navigating through the myriad user experiences with Credit Strong reveals largely positive consensus on its impact and utility in credit-building. Many users have expressed appreciation for the platform’s straightforward approach to improving credit scores, highlighting the ease of setting up secured credit accounts and the clarity of the credit-building process. Testimonials highlight tangible results over time, with users noting credit score improvements due to Credit Strong’s consistent reporting to bureaus. For instance, John D., a user from Texas, shares, “After using Credit Strong for just six months, I’ve seen my credit score jump by over 50 points. The process was easy to start, and seeing my progress through the app has been incredibly motivating.”

However, like any service, Credit Strong has areas where users wish for improvements. Some critiques focus on the desire for more personalized customer service interactions and clearer explanations of available product options. Despite areas for improvement, user sentiment is overwhelmingly positive, valuing the platform’s role in their financial improvement journey. Emily R., from California, reflects a common sentiment: “Credit Strong has been a game-changer for me. I was initially skeptical, but the user-friendly app and the visible improvement in my credit score have made me believe. It’s been essential in repairing my credit and working towards financial stability.”

Benefits and Considerations

Choosing Credit Strong for credit building comes with advantages and factors to consider. Prospective users must weigh these aspects carefully to determine if Credit Strong aligns with their financial goals and circumstances. Here’s a concise overview of the benefits and considerations associated with using Credit Strong’s services:

Benefits:

- No Initial Credit Check Required: Credit Strong is accessible to many, including those with low or no credit history.

- Potential for Credit Score Improvement: Consistent, on-time payments are reported to credit bureaus, potentially boosting users’ credit scores.

- Flexible Account Options: Offers a variety of products tailored to meet different credit-building needs, from beginners to those repairing credit.

- Savings Component: Certain Credit Strong accounts allow building savings while enhancing credit, merging financial growth with credit improvement.

Considerations:

- Associated Fees and Interest Rates: Users should know the costs involved, including monthly fees and interest rates on loan products.

- Long-Term Commitment: Achieving significant credit improvement requires a long-term commitment to making regular payments.

- Understanding Terms and Conditions: Users must thoroughly understand the terms of their account to avoid surprises.

Begin your credit-building journey with Credit Strong

Credit Strong is a formidable ally in improving financial health, offering innovative credit-building and savings opportunities. Through this comprehensive review, we’ve unpacked the nuances of Credit Strong’s offerings, from its user-friendly app to the diverse accounts designed to cater to various financial goals and backgrounds. The platform’s commitment to credit enhancement is evident, supported by positive testimonials and a structure fostering credit score growth. However, like any financial service, it involves considerations such as fees and requires long-term engagement for significant results. Weighing these factors is essential for leveraging Credit Strong as a step towards financial resilience and creditworthiness.

Motivated to control your financial future and boost your credit score? Credit Strong offers a promising pathway. With secured credit accounts and loans, plus a user-centric approach, entering credit improvement has never been more accessible. Start by exploring Credit Strong’s diverse offerings and aligning their services with your financial aspirations. Remember, the path to a robust credit score and healthier financial standing begins with informed choices and proactive steps. Explore Credit Strong today and take a big step towards securing your financial well-being and unlocking new opportunities.